Greatest Money Advance Programs Regarding 2025

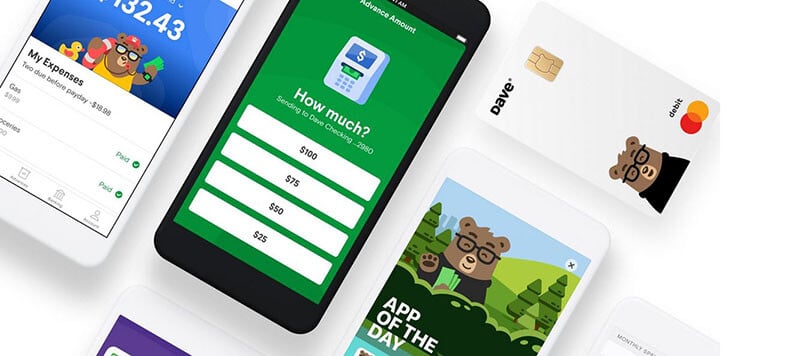

Along With zero interest upon funds improvements in addition to a focus on economic wellness, Sawzag gives a user-friendly solution for handling initial financial needs. UnaCash is usually a simple line of credit that allows Filipinos bridge financial spaces. With versatile financial loan conditions in addition to lower curiosity rates, the particular application is usually especially beneficial in buy to individuals that are making use of credit with respect to typically the very first period.

Top Something Like 20 Finest Reward Applications Regarding Cash Back Again

- The software could keep track of your financial action to determine cash you could arranged aside inside the particular app’s AutoSave bank account, or a person could set a particular time frame to become able to move money right today there.

- An Individual can pay automatically upon your following payday, pay previously, or pay within repayments.

- Investment and buying bitcoin entails chance; a person might shed cash.

- The Particular app furthermore offers a soft cash borrowing encounter, allowing customers to become able to request funds and receive them directly in their accounts.

Nevertheless, a person may not necessarily borrow cash app qualify with consider to the particular optimum advance initially—you may uncover bigger quantities as you pay off more compact advancements. Cash App will be ideal regarding consumers who else would like a totally free approach in order to instantly send out and obtain payments. Just link a bank accounts or publish cash to Funds Software to send out repayments to any person within the ALL OF US or UNITED KINGDOM.

Ought To I Consolidate Credit Rating Card Personal Debt Along With A Individual Loan?

Banks, credit unions, on-line lenders, in inclusion to peer-to-peer lenders just like Be Successful offer individual loans. Typically The lender works a credit check just before approving an individual regarding a loan. Several personal loans, referred to as guaranteed loans, likewise require some form regarding collateral, such as a vehicle or money in your current financial institution bank account. Unsecured loans don’t demand collateral, nevertheless they generally have increased curiosity rates. It provides solutions just like interest-free funds advances, private loans, credit score monitoring, plus maintained investment decision balances, all available by means of a user-friendly cell phone application. You’ll furthermore want to supply some simple individual info plus have got your own identification in inclusion to bank bank account verified.

Cashapp Borrow Feature: Fast How-to

- A Person may acquire a private loan with regard to as lower as 3% AP when a person have great credit score.

- Typically The application provides speedy in addition to instant loans without having collateral, guarantors, or paperwork plus has a financial loan amount upwards to N1,500,500.

- There are a quantity of positive aspects associated with borrowing cash through a great application rather as compared to heading in order to a local bank or pawnshop in order to try out plus get speedy cash.

- Money Application will allow an individual know just how very much cash you are usually approved to be in a position to borrow.

- Thus, prior to putting your personal on away from on a financial loan, examine the overall price in purchase to make sure applying your current credit score cards wouldn’t become cheaper.

Cleo won’t charge virtually any interest or late fees, but it has a $5.99 membership payment. Unlike many some other programs, Cleo lets a person choose your current own repayment day, although it need to become inside 16 days regarding borrowing. Online Loans Pilipinas (OLP) is a fintech platform that gives electronic monetary options to be in a position to Filipinos’ requires. OLP gives fast plus simple financial remedies with regard to each Filipino’s financial needs with out business office trips, collateral, or complicated acceptance processes.

How Perform I Consolidate The Credit Rating Card Financial Debt Together With Bad Credit?

We measured mortgage sums, turnaround periods, membership costs, typically the period between advances in addition to membership requirements. Money Software costs a flat 5% charge, which usually is usually fairly uncomplicated compared in buy to standard payday loans. It’s simply no key that will monetary anxiety is usually a significant problem with regard to many Americans.

It’s a secure, all-in-one solution with regard to smarter investing, preserving, and earning rewards. We up-date our information regularly, but info could alter between up-dates. Confirm details along with typically the service provider a person’re serious in just before generating a choice.

Quickcheck Financial Loan

A personal financial loan through a lender, credit union, or online lender may possibly end upwards being a far better choice when you need in buy to borrow a large amount in inclusion to distribute obligations over a extended moment framework. MoneyLion is not necessarily compatible along with PayPal, since it demands an association to end upwards being able to a financial institution bank account in purchase to supply funds improvements and keep track of purchases. You will require in purchase to link it with a standard bank account to get a cash advance plus entry the other features. With money borrowing programs, an individual can borrow $200 in addition to proceed as high as $100,1000. The Particular many beneficial function associated with the particular Android os app is interest-free cash improvements up to end upwards being able to $100 to become able to bridge the distance among paychecks – although your 1st advance may possibly become as reduced as $5.

- Palmpay financial loan program is a good automated lending support concentrated upon growing entry to credit to be able to financially under-served/excluded individuals inside Nigeria plus additional Africa nations.

- Typically The programs below allow you to end upwards being capable to borrow cash from your next paycheck instantly.

- The app exhibits the particular earned earnings, in addition to a person could pick typically the amount a person require to become capable to borrow in addition to pay off it about your current next payday, without virtually any interest or charges.

- Nevertheless these people have got several characteristics in inclusion to can assist you together with immediate loans or long lasting monetary solutions.

Money Advance Apps Such As Cleo Of Which Loan Money

Nevertheless, comparable in purchase to payday loans, some applications cost large charges, which often may translate in to sky-high APRs. Even Though inquiring a family members member or good friend in buy to borrow funds can become hard, these people may become willing in purchase to give you even more beneficial terms compared to a standard lender or funds advance app. If an individual find a person prepared to become able to provide you cash, pay off this promised to avoid a achievable rift inside your partnership. Present will be a cell phone banking program of which gives the very own banking providers.